KATALOGI AVON 2024 POLSKA ONLINE

Witamy w świecie piękna z kosmetykami AVON!

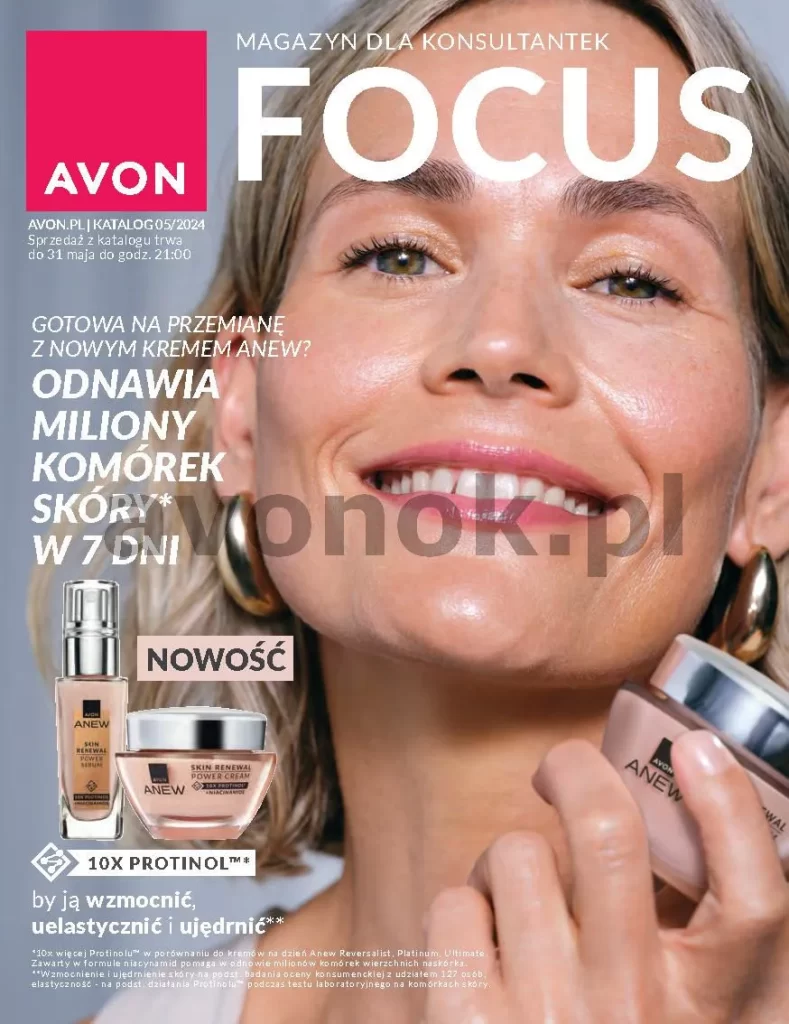

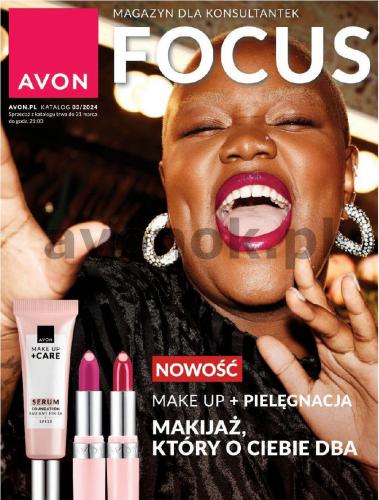

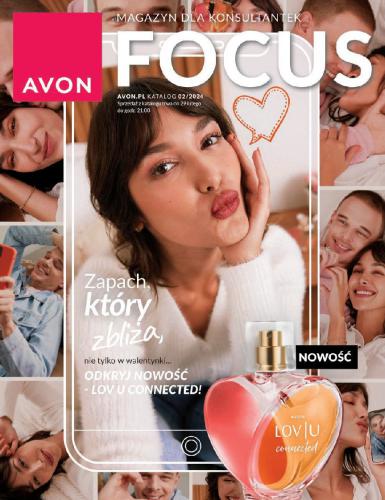

Zobacz aktualne katalogi Avon Marzec, Kwiecień, Maj 2024 online

Nasza strona internetowa prezentuje Polski katalogi Avon i na naszej stronie wkrótce możesz obejrzeć najnowszy katalog Grudzień 2023 w wersji elektronicznej:

Zostań przedstawicielem Avon i uzyskaj do 30% zniżki na wszystkie produkty oraz możliwość udziału w zamkniętych wyprzedażach, programach z nagrodami i innych przywilejach po rejestracji! Znajdź punkt dostawy swego pierwszego zamówienia i dowiedz się, jaki prezent czeka na Ciebie przy pierwszym zakupie! Wypróbuj bezpłatną dostawę zamówienia do punktu odbioru lub kurierem.

Jeśli odwiedzasz naszą stronę internetową z katalogami Avon e formie elektronicznej online, to już znasz nasze produkty! To nas bardzo cieszy i motywuje. Dowiedz się krótką historię naszej perfumeryjno-kosmetycznej firmy na naszej stronie.

Katalog Avon 4/2024, 5/2024, 6/2024 wkrótce pojawi się na stronie avonok.pl

Avon to popularna międzynarodowa firma kosmetyczna, która powstała w 1886 roku. Ma ona własne zakłady produkcyjne, dobrze zorganizowaną logistykę, obszary marketingu i dział sprzedaży. Ponadto naszym głównym zaszczytem jest centrum badawcze, które prowadzi różne badania laboratoryjne i tworzy innowacje w zakresie urody.

Historia Avon rozpoczęła się od amerykańskiego przedsiębiorcy, który stworzył małą firmę perfumeryjną, aby pomóc kobietom w spełnieniu ich marzeń poprzez budowę własnego biznesu. Dlaczego taki pomysł był aktualny? W tamtych czasach panie w Ameryce nie mieli prawa głosu w wyborach rządowych, a tylko 20% pań miało możliwość zarabiania pieniędzy we własnym kraju. David McConnell (założyciel Avon) był tak bardzo poruszony z tego powodu, że postanowił pomóc każdej kobiecie założyć własny biznes!

Avon to nie tylko kosmetyki – to szansa dla każdej kobiety, aby poczuć swoją siłę i piękno, zyskać pewność siebie i wartość w społeczeństwie!

Cenimy sobie naszą reputację, a nasza działalność opiera się wyłącznie na przejrzystości i przestrzeganiu zasad, które są dla nas fundamentalne!

5 KLUCZOWYCH ZASAD BIZNESU Z AVON

- Zaufanie. Wspieramy wyrażanie własnych opinii i uczuć. Dla nas bardzo ważna jest otwarta komunikacja w pracy.

- Wiara. Jedna z tych wartości, które nas inspirują. Wierzymy w każdą osobę i widzimy jej niesamowity sukces!

- Szacunek. Pomoc każdej osobie jest czymś, co cenimy i wspieramy. Sprzyja to w jak największym pokazywaniu swoich umiejętności.

- Uczciwość. Biznes to współpraca między ludźmi. Przede wszystkim zwracamy uwagę i troszczy my się o każdego klienta, przedstawiciela i pracownika. W końcu ludzie są podstawą biznesu.

- Skromność. Nikt nie jest idealny, każdy może popełnić błąd. Jesteśmy za to, by móc prosić o pomoc innych bez wahania.